"Company Outlook

Foot Locker reaffirms its full-year non-GAAP EPS outlook of $1.50 to $1.70.

Positive sales and gross margin trends are expected to continue,

Foot Locker reaffirms its full-year non-GAAP EPS outlook of $1.50 to $1.70.

Positive sales and gross margin trends are expected to continue,

with an improvement in comparable sales and average unit retail.

The company anticipates a return to growth with Nike (NYSE:NKE) by the fourth quarter.

The Paris Olympics are expected to provide a commercial boost to the company's sales.

Bullish Highlights:

-Basketball footwear sales were strong, driven by Nike and Jordan Brand.

-New Balance and adidas recorded impressive growth in Q1."

The company anticipates a return to growth with Nike (NYSE:NKE) by the fourth quarter.

The Paris Olympics are expected to provide a commercial boost to the company's sales.

Bullish Highlights:

-Basketball footwear sales were strong, driven by Nike and Jordan Brand.

-New Balance and adidas recorded impressive growth in Q1."

感想

正在整理淘汰低效率店面,店數或再縮,

但盈餘有再好轉。

另外nike策略回頭改跟經銷多合作,

或許能助其回溫。

另外nike策略回頭改跟經銷多合作,

或許能助其回溫。

過去有縮股本的紀錄,或許推動EPS成長,

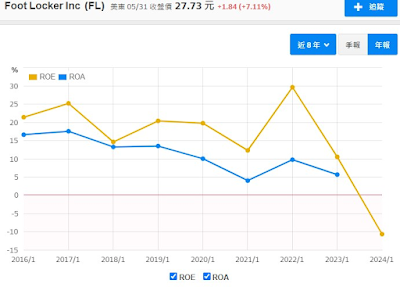

ROE 或有回到15~20%,eps 均4-5元的可能?

forward pe 5-6倍,但不確定在於何時可以實現,要2-3年吧?

拿幾家nike的合作商,來double check豐泰,感覺也是滿有收穫的?

似乎開始有預期差出現了,ㄎ

沒有留言:

張貼留言